In the world of finance, a long-standing belief persists: trading is a game best left to large institutional investors. This myth suggests that retail investors lack the resources, technology, and market influence to compete effectively. However, recent developments challenge this notion, revealing that retail traders are not only capable but may sometimes be better positioned than their institutional counterparts to outperform the market.

A critical factor in trading efficiency is market impact—the effect a trade has on the price of a stock. Large orders can move markets, leading to higher costs for traders. Institutional investors, dealing with significant sums, often face substantial market impact. In contrast, retail investors typically trade smaller volumes, resulting in minimal market disruption and lower trading costs.

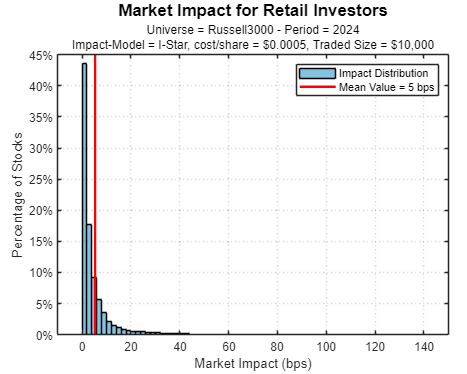

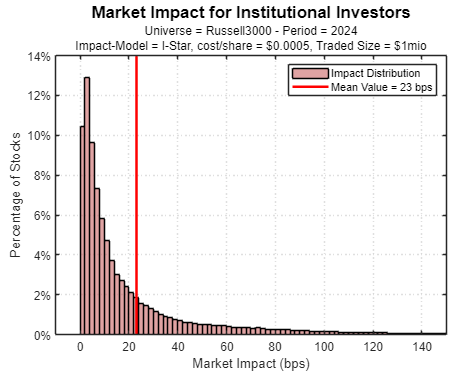

To illustrate this, we analyzed the market impact distribution for all stocks in the Russell 3000 index for the year 2024. Using a market impact model that accounts for trade size and associated commissions, we compared the experiences of retail traders and institutional investors. For retail traders, we assumed a trade size of $10,000, while for institutional investors, we considered a $1 million notional amount.

Our market impact model also incorporated the commission structures offered by Interactive Brokers, a leading brokerage firm. Retail clients are charged $0.0035 per share, with a minimum cost of $0.35 per transaction. Institutional clients receive a lower rate of $0.0005 per share due to their higher trading volumes. Despite lower per-share commissions, institutions often incur higher total costs due to larger order sizes and increased market impact.

The first histogram showcases the distribution of market impact for retail investors. The horizontal axis represents the market impact in basis points (bps), while the vertical axis shows the percentage of stocks. Remarkably, the data reveals that approximately 75% of stocks in the Russell 3000 can be traded by retail investors with a market impact of less than 5 bps. This low impact is attributed to the modest trade size, which doesn’t significantly affect stock prices.

In contrast, the second histogram depicts the market impact distribution for institutional investors. Here, only about 30% of stocks are liquid enough to be traded with a market impact of less than 5 bps. The larger trade size of $1 million means institutions are more likely to influence stock prices when executing trades, leading to higher market impact and increased trading costs.

Analyzing these histograms underscores a crucial advantage for retail investors: lower market impact translates to more efficient trading and cost savings. While institutional investors benefit from lower per-share commissions, their substantial trade sizes often negate these savings due to higher market impact. Retail traders, with their smaller orders, can navigate the market more stealthily, preserving capital and maximizing returns.

For example, suppose a retail investor and an institutional investor both trade the same momentum strategy. The strategy rebalances the portfolio at the end of each month, where all positions are unwound and new positions are entered into the portfolio. Assuming a turnover of 100% per month, the retail trader is expected to have a performance drag of approximately 10 bps per month (5 bps for closing positions and 5 bps for opening positions), while the institutional investor is expected to face a headwind of almost 50 bps per month. Over a one-year period, this means the retail trader is expected to have a market impact drag that is 480 bps, or 4.8%, lower than that of the institutional counterpart.

Moreover, the trading landscape has evolved significantly, leveling the playing field for retail investors. Technological advancements have led to sophisticated broker APIs, granting retail traders access to tools once reserved for institutions. Platforms like Interactive Brokers offer robust APIs that enable automation of trading strategies. This automation not only enhances efficiency but also helps mitigate psychological biases that can adversely affect trading decisions.

Even for those without coding expertise, the barrier to entry is lowering. A wealth of resources is available, from user-friendly platforms to a vast community of skilled programmers eager to collaborate. Retail investors can now implement complex trading algorithms, backtest strategies, and execute trades automatically, all while maintaining control over their investments. In the last two years, we have referred our readers to highly skilled freelancers who have helped them effectively automate their trading strategies.

However, with greater accessibility comes greater responsibility. While retail investors are better positioned than ever before, they are also exposed to higher risks if their trading does not rely on solid foundations. The allure of sophisticated tools and easy market access can lead to hasty decisions without proper understanding. It’s extremely important for retail investors to educate themselves before diving into trading.

Fortunately, there are plenty of resources available to help build this foundation. From comprehensive books covering trading fundamentals to simulators that provide risk-free environments for practice, retail investors have numerous ways to gain experience. Podcasts and online courses, many offered by top universities for free, provide structured learning paths covering everything from basic concepts to advanced strategies.

The democratization of trading resources signifies a transformative period for retail investors. By understanding and leveraging lower market impact, competitive commission structures, advanced trading technologies, and the wealth of educational resources available, individuals can effectively navigate the financial markets. The notion that trading success is reserved for large institutions is no longer valid. Retail investors are not just participants but may be even better positioned to outperform institutional counterparts.

For any further details about this article, feel free to contact me at carlo@concretumgroup.com.