Intraday trading strategies have gained significant recognition for their ability to capture short-term market inefficiencies and extract uncorrelated returns.

From time-tested opening-range breakouts (ORB) to volatility-based approaches, these strategies can deliver strong results when executed correctly.

However, the speed, precision, and scale required to implement them effectively are nearly impossible to achieve manually. This underscores the necessity of automation, which forms the central focus of this article.

The Challenges of Manual Execution

Even straightforward strategies are difficult to execute manually in real-time. Here’s why:

- High-Speed Decision Making: Markets move fast, and even a few seconds of hesitation can cost opportunities.

- Scanning Multiple Tickers: Filtering thousands of stocks using technical indicators overwhelms manual efforts.

- Complex Position Sizing: Adjusting order sizes for volatility and risk tolerance on the fly increases the chance of errors.

- Simultaneous Execution: Managing multiple trades across ten or more tickers challenges human coordination.

- Dynamic Risk Controls: Continuously recalibrating stop losses and profit targets is labor-intensive.

- Emotional Interference: Fear, greed, and second-guessing often disrupt disciplined execution.

- Constant Monitoring: Intraday trading demands full attention, leading to fatigue and burnout.

Why Automation is a Game-Changer

Automation transforms what’s impossible manually into a streamlined, scalable process. Modern platforms with advanced APIs and integration tools now bring institutional-level capabilities to retail traders..

With automation, you can:

– Execute trades with precision, free from emotional bias.

– Scan thousands of stocks and rank them by indicators like Relative Volume.

– Dynamically size positions using volatility data for consistent risk management.

– Submit multiple orders simultaneously to avoid manual delays and errors.

– Automatically manage stops, targets, and closures, freeing up your mental bandwidth.

A Real Example

Our fully automated system, built using the approach from our research paper, “A Profitable Day Trading Strategy For The U.S. Equity Market,” shows the power of automation.

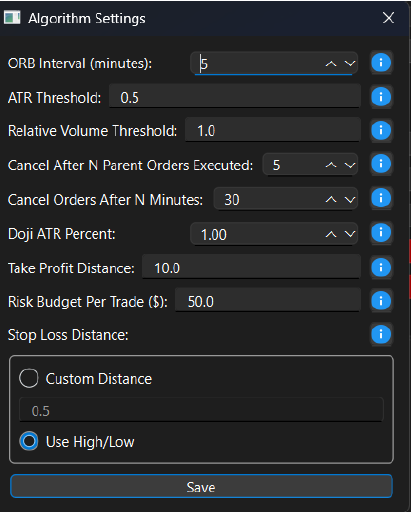

Before the market opens, the system allows users to specify parameters that determine how, when, and what to trade. These settings include filters like Relative Volume thresholds, trade timing, and risk management preferences. The image below showcases the Settings Page, where users tailor the algorithm to their unique strategies.

By the time the chosen ORB minute (e.g., the 5th minute) arrives, the system has already:

1. Screened over 10,000 U.S. stocks.

2. Narrowed the list to the top 50 stocks by Relative Volume.

3. Verified technical conditions, such as doji patterns.

4. Selected the 20 most promising candidates.

At the exact moment required, it places tens of stop-orders simultaneously. Manually achieving this level of speed, precision, and scale would be impossible. With automation, it’s fast, consistent, and repeatable.

Below is a video showing how the algorithm worked during a random day last week. A few seconds before the close of the first 5-minute candle (with the clock set to Central European Time, where 15:35 corresponds to 9:35 ET), the algorithm runs computations, ranks stocks by Relative Volume, and sends stop-orders at the highs and lows of the opening range.

Key Components of a Successful Automated Setup

To ensure efficient execution, your system needs:

1. Reliable Market Data Feeds: Low-latency real-time and historical data fuel strategy decisions. (We recommend IQFeed and Polygon.io.)

2. Brokerage API Access: Direct connections enable instant trade execution without manual intervention.

3. Algorithmic Trading Codebase: Translate trading logic into automated, executable code.

4. Risk Management Modules: Automated stop-losses, trailing stops, and volatility-based sizing protect capital.

5. Performance Monitoring: Dashboards and alerts let you adjust parameters without constant screen time.

6. Comprehensive Reporting: Receive daily trade breakdowns, categorized by strategy. Store historical data with details on slippage, commissions, and P&L for ongoing refinement.

Translate Your Trading Idea into an Algorithm

While tools and APIs make automation more accessible, transforming your trading ideas into a stable algorithm can be challenging. Thankfully, resources like experienced freelancers, educational materials, and online communities can help.

By integrating automation into your trading workflow, you can make the journey more efficient and far less stressful. With manual execution offloaded to algorithms, you’re free to focus on researching and refining new strategies, creating a more diversified and resilient portfolio.

This blend of precision, scalability, and continuous improvement smooths the trading journey, helping investors unlock their full potential while navigating markets with confidence and clarity.

For any further details, feel free to contact me at carlo@concretumgroup.com