In short-term trading systems, delaying the execution of a signal can lead to a meaningful deterioration in performance. Many systematic traders design strategies under the assumption that any signal computed at the market close should be executed on the next day’s open.

This workflow has a clear and important advantage: it keeps the live trading process perfectly aligned with the out-of-sample backtest. Signals in live trading are computed using the same closing prices used in the historical simulation, and executions are performed via Market-on-Open (MOO) orders that, at least in theory, match the open prices used in the backtest. The result is a clean, reproducible, and easily verifiable framework.

However, the major drawback of this approach becomes evident for very short-term strategies where the average holding periods are < 3 days. By waiting roughly 17 hours between the close of day t (4:00 PM) and the open of day t+1 (9:30 AM), a strategy may lose a substantial fraction of its intended edge. In many mean-reversion or microstructure-based signals, this delay can outright erase the profit potential.

So, what are the alternatives? And how do we judge which execution scheme is best?

1. Computing and executing at the market close

The most straightforward alternative is to compute the signal shortly before the close and execute it immediately at the close. At this point, many systematic traders will shudder: after all, they have been taught that execution must always be lagged by at least one bar to avoid look-ahead bias. And while I fully agree with the reasoning behind this teaching, I also believe that today’s technology challenges the need for such a rigid constraint.

We no longer need 17 hours to compute a trading signal. If the computation takes milliseconds, why force ourselves to wait until the next day?

In practice, computing a reasonably complex signal a few seconds before the close is technically viable. One could compute the signal at, say, 15:59:50, and immediately submit a market order. The downside, however, is not computational, it’s microstructural.

In the final seconds of trading, bid–ask spreads tend to widen, and depth often collapses. A market order placed in the last 5–10 seconds can easily be filled at an unfavorable price: for short-term systems where expected PnL per share is already small, this slippage can overwhelm the alpha.

2. Computing the signal at 15:45 and using Market-on-Close (MOC) orders

A more elegant and practical solution is to compute signals 15 minutes before the close and execute the trades via Market-on-Close (MOC) orders. This approach offers several benefits:

- It removes the slippage problem that plagues last-second market orders, as closing auctions tend to offer deeper and more stable liquidity.

- It reduces the signal–execution delay to only 15 minutes, preserving most of the alpha for strategies with short half-lives.

- It keeps live trading aligned with the backtest; MOC orders generally fill at the official closing price, which is precisely the price used in close-to-close backtests.

This method, however, is not without drawbacks:

- It requires intraday data for proper backtesting. Signals must be historically computed at 15:45, which means you need timestamped intraday bars to replicate the live process.

- The opportunity set may differ from the “true close” version. A trade that looks attractive at 15:45 may no longer be attractive at 16:00. Conversely, some signals that appear at the close would not have triggered at 15:45. In other words, this approach defines a different strategy, even if related to the original one.

Case Study on SPY

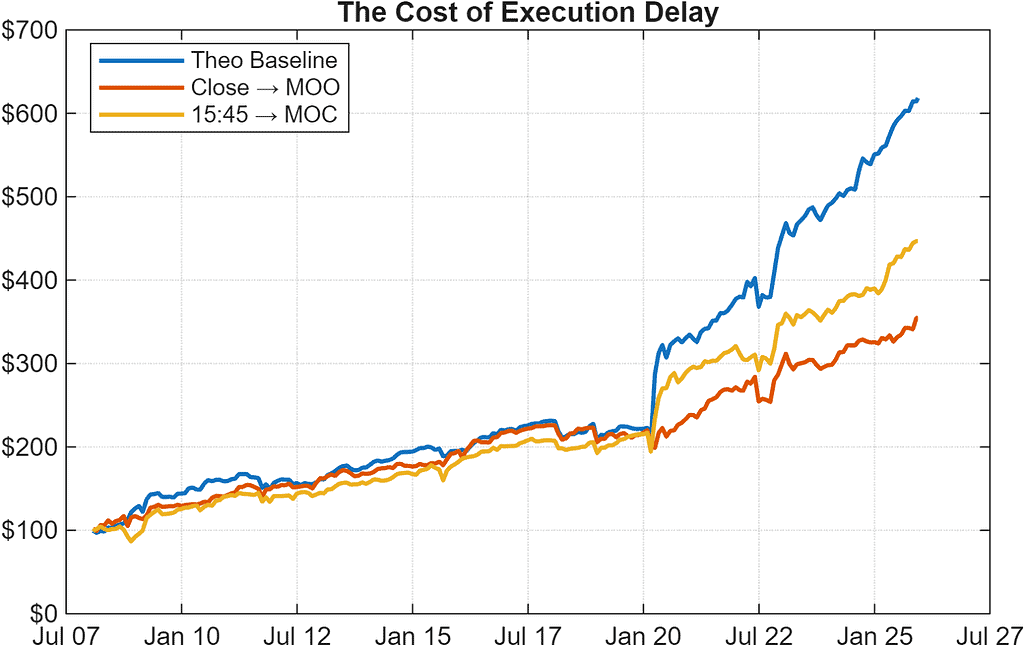

To quantify the impact of execution timing, we tested a proprietary short-term mean-reversion indicator on SPY using three different approaches.

Theo Baseline. The first is a theoretical baseline in which the signal is computed at the close and the trade is assumed to execute at that same closing price, an idealized scenario that is not implementable (at least without slippage) but provides a good strategy benchmark.

Close -> MOO. The second computes the signal at 15:45 and executes via a Market-on-Close order: this method introduces only a 15-minute delay and reflects a realistic low-latency workflow.

15:45 -> MOC. The third follows the classic “signal at the close, execution at the next open” logic, delaying the trade by roughly 17 hours.

Results are illustrated in the following picture

When comparing the three, the differences are clear.

The theoretical version delivers a cumulative return of roughly 520% with an average return per trade of 31 bps, a hit ratio of 74%, and a total of 611 trades.

The 15:45/MOC approach tracks it reasonably well, although with a clear performance loss: cumulative return falls to 346%, average trade return to 27 bps, while the hit ratio remains close at 71%. Roughly 61% of its entries overlap with the theoretical ones, confirming that the opportunity set is similar but not identical.

The next-open execution brings additional performance degradation. Cumulative return drops to 254%, the average return per trade falls to 22 bps, and the hit ratio declines to 63%. All its trades coincide with the theoretical set, but many of those suffer from overnight moves that erode the strategy’s edge.

Overall, the case study reinforces the idea that for fast-decaying signals even small execution delays matter. The theoretical close-to-close strategy remains the upper bound; the 15:45/MOC implementation preserves most of its alpha in a practical setup; and executing at the next open, while simple, leaves too much performance on the table for this class of short-term strategies. In other words, the evidence confirms that for fast-decaying signals, execution delay is a first-order effect rather than a secondary implementation detail.

Closing Remarks and Ongoing Research

Execution timing is not a minor operational choice in short-term trading systems; it is often the dominant factor determining whether a strategy survives the transition from backtest to live trading.

The traditional “signal at the close, execution at the next open” framework remains appropriate for slower-moving alphas and for implementations that prioritize simplicity. However, for strategies whose half-life is measured in hours, modern infrastructure enables more precise and better-aligned alternatives.

Computing signals shortly before the close and executing via Market-on-Close orders often represents a compelling compromise: limited alpha decay, realistic backtests, and manageable execution risk.

As a next step, we will extend this analysis beyond SPY. In an upcoming follow-up, we will replicate and expand this study using individual stocks from the Nasdaq 100 over the last 10 years, allowing us to assess how execution timing interacts with cross-sectional dispersion, liquidity heterogeneity, and stock-specific microstructure effects. This extension will provide a more comprehensive view of how execution delay impacts short-term strategies in a broad and survivorship-bias-free equity universe.