Shorting US equity markets has always been a challenge for active traders due to the positive long-term drift, commonly referred to as the equity risk premium.

One common method to avoid the headwind from this long-term market drift is either to completely bypass the short side of a trading signal or to add a market regime filter. This filter allows traders to take short positions only when the market is in a bear phase (often identified using Moving Averages) or when market volatility is elevated.

We decided to take a deep dive into the short leg of the intraday momentum strategy proposed in our paper Beat the Market,An Effective Intraday Momentum Strategy for S&P500 ETF (SPY) to answer the following key questions:

Q1. Does the profitability of short trades increase when market volatility is high?

Q2. How does total profitability change if we only trade when the VIX is above a certain threshold?

Q3. Should we open short trades only when the market is trading below key SMAs?

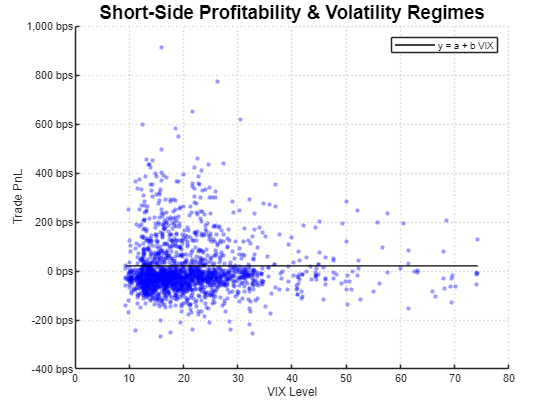

Let’s start with Q1. We ran a simple linear regression between the PnL (in basis points) of each short trade and the average VIX level on the same day. Contrary to common belief, we found no significant relationship between VIX and short trade profitability. This is visually confirmed by the flat black line representing the fitted linear relation. Additionally, a p-value of 0.91 for the beta reinforces this conclusion.

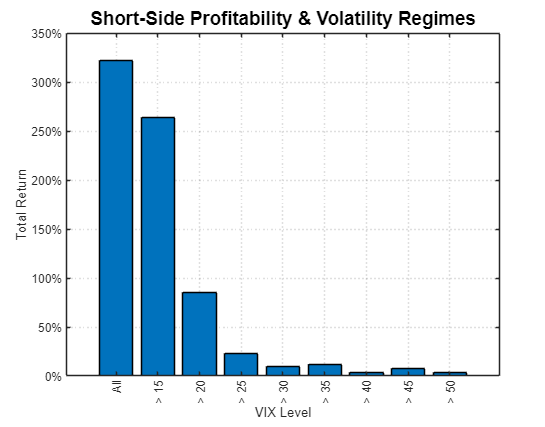

The next bar chart shows the total return of all short trades, conditioned on the VIX being above a certain threshold. In other words, how much money did short trades generate if we only traded when the VIX was sufficiently high? This chart further confirms the regression results: limiting short trades to high volatility environments does not benefit overall compounded performance.

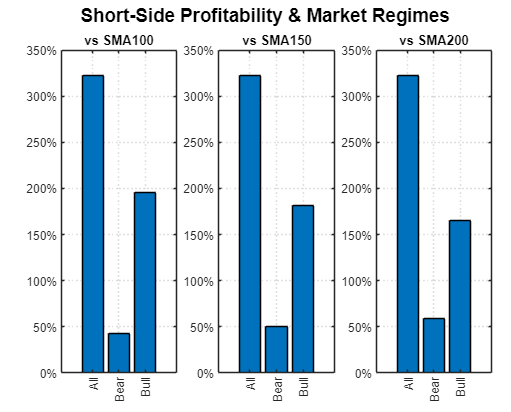

Finally, we examined the common adage suggesting that traders should only trade in the direction of the higher-time frame trend. We identified trends using three different Simple Moving Averages: 100, 150, and 200 days. The charts suggest that traders who take short intraday trend exposures only during bear markets are sacrificing a substantial portion of overall profitability.

In conclusion:

1. The profitability of shorts is not impacted by market volatility.

2. Avoiding shorts in low-volatility regimes negatively impacts long-term compounding.

3. Don’t worry about higher-time frames; there are plenty of short-trend opportunities to exploit, even during bull markets!

You can read the original paper for free here –> http://bit.ly/BeatTheMarketSPY

In case you have any questions do not hesitate to contact me!